The Ringing of the Cowbell // Variant Perception #22

I was checking my stock portfolio on Friday when I noticed that Apple stock is on a tear, surging to new all-time highs.

Now, that’s interesting. I thought we’re in a bear market? What about high rates and inflation? I took a deeper look. Surely they’ve had good earnings growth and strong revenue because that’s what drive’s stock prices, right?

Nope.

Back in March of 2022, Apple had record high trailing 12 month earnings of $6.15 with a stock price of $173 and P/E ratio of 28.

Today, with a stock price over $190, Apple has a P/E ratio of 32 and is expected to have negative earnings growth over that same period.

So, what gives? I thought higher rates were supposed to tame the wild, speculative asset inflation we’ve seen post-covid? I thought J. Powell said that rates will be higher for longer and will continue to get hiked this year?

Well, for a small group of innovative financial analysts, they say to follow the money… printer.

There’s a new and growing body of work in finance around trading liquidity and the central bank balance sheets that’s beginning to gain traction after the pandemic.

Why after the pandemic? Well, that’s when the “money printer” consciousness hit the mainstream. As the Fed hit the panic button (I’ll argue rightfully so), the memes began to roll in.

For so many, it became clear as day. The second the money printer turned on asset prices soared in the face of the worst economic shock in modern history. The shittier the stock the better. Bonus points if they went bankrupt. Remember Hertz, AMC, and GME stocks soaring?

Yet, while the meme’s are hilarious, they kicked off a deep-dive into the actual effect of money printing (aka liquidity) on asset prices. And, while it’s been happening for all of the 2010s, the link between printing money and assets screaming higher became obvious as day.

There’s two people who I follow that can be seen as the pioneers on the topic, Raoul Pal and Darius Dale. Both have different frameworks that show the same path… MOAR COWBELL aka more debt financed by the world’s central banks.

Although J. Powell has been steadfast in saying his mission is to fight inflation, I believe the gravity of the debt will win. Interest rates cannot stay high for long because it will be far too expensive to finance all of the government’s debt that’s coming down the pipe. All the money that would instead go towards funding our government will go towards paying interest. It’s a massive tax and headwind on the economy.

So, the world’s developed economies find themselves in a pickle. Central banks must use debt to fuel growth because productivity and demographics cannot. This creates risks and pockets of inflation. However, it also has a unique effect on asset prices.

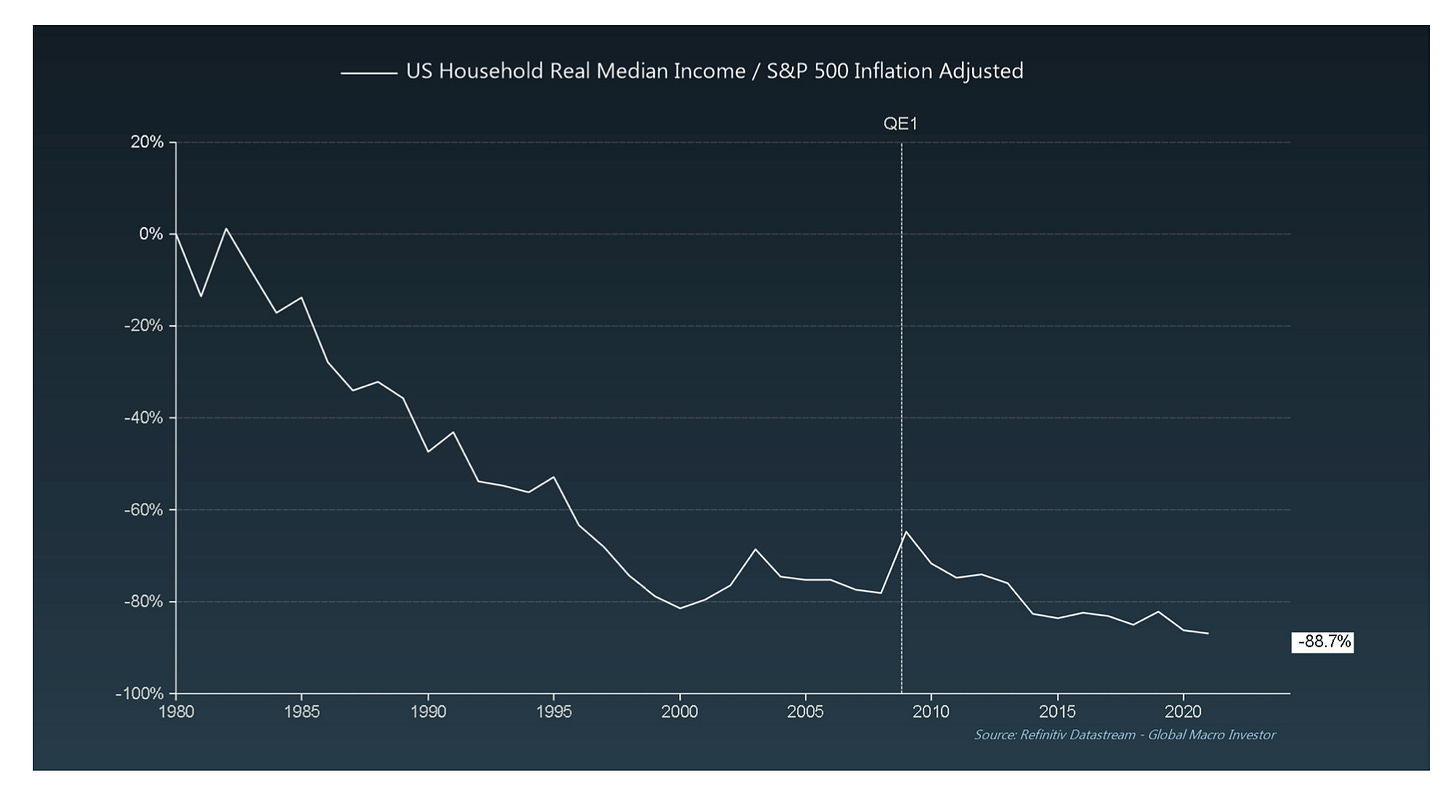

Darius and Raoul are discovering in their analysis that market returns are highly correlated to central bank liquidity.

Raoul believes this to be the cause and effect of currency debasement. The more dollars that exist in the system the more dollars are needed to buy the same unit of scarce asset.

Others see this as money that flows into assets through complicated piping of the financial system.

What’s true, however, is it doesn’t matter. The global central banks are painted into a corner. And they’ll always choose the potential risks of currency debasement over the known risks of debt deflation.

As I’ve shared before, I look for when different minds converge to view the world in the same way. This seems to be one of those moments. The market is no longer (and hasn’t been for a while) ruled by fundamentals.

If it were, would Apple be rocketing to new ATHs on multiple expansion even in the face of higher rates? The market looks forward, but the forward growth expectations do not align with such a large increase in the stock price.

I’ve talked before about how economic growth is too low. Productivity and population (the two drivers of real growth) have stalled and their rate of growth is declining. This forces governments to rely on adding more debt to generate growth.

And, as I’ve shared before, each unit of debt used to fuel growth has a negative forward efficacy; the more debt we use today means the more debt that will be needed tomorrow to gain the same effect.

This is the trap that’s been laid and it’s why I say the central banks are painted into a corner.

Productivity and demographics are stagnant. They cannot be the near or intermediate sources of growth. Debt will be used to keep the economies functioning and the money flowing. Because debt has a negative forward efficacy, more debt will be needed in the future all things being equal.

Once again, the central banks and governments of the world will always choose currency debasement over a full-blown debt deflation. Yes, printing money today and adding to our debt load carries risks. Allowing the economy to go bust seems to carry a lot more.

So, more government debt is inevitable. It’s the only thing that’s holding up global growth in the most developed nations. Productivity will only turn when technology goes exponential (think AI, automation, robotics, etc). Demographics is a slow tanker cruiser that will not turn in the next 50 years. The math is already written.

If more government debt is inevitable, that means more money printing is inevitable. And if asset returns are highly correlated to net liquidity, you want to be long going into a spike in liquidity.

Which brings me back to this meme…

Sometimes the best strategy is the most simple.

Stay vigilant,

-Jared