Debt Rules Everything Around Me // VP #11

Why our governments will never stop printing more money.

Two parts rising debt, one part high inflation, three parts political stagnation and a twist of global power struggle.

That’s the strong, liquor-forward cocktail we’re shaking up right now. And it’s a doozy. All signs point to a more volatile next decade than the previous.

Which reminds me of this Lenin quote:

“There are decades where nothing happens; and there are weeks where decades happen.” - Vladimir Ilyich Lenin

We’re in that period where decades will happen in weeks. Which brings me to the economic quagmire that we’re in. We have far too much debt. This creates a predictable, although undesirable, set of consequences we’ll face over the next 10 years.

To better understand those consequences, you must know the relationship between population, productivity, and debt.

All major economic growth relies on three pillars: population, productivity, and debt. These pillars form the core building blocks of economic activity (aka GDP).

GDP Growth = Population Growth + Productivity + Debt Growth

Growth in populations creates a natural and increasing need for investment and spending, while population decline has the opposite effect. A young population has different spending and investing patterns than an old one. Compare the spending patterns of India (median age of 28) to Japan (median age of 49 and oldest country in the world).

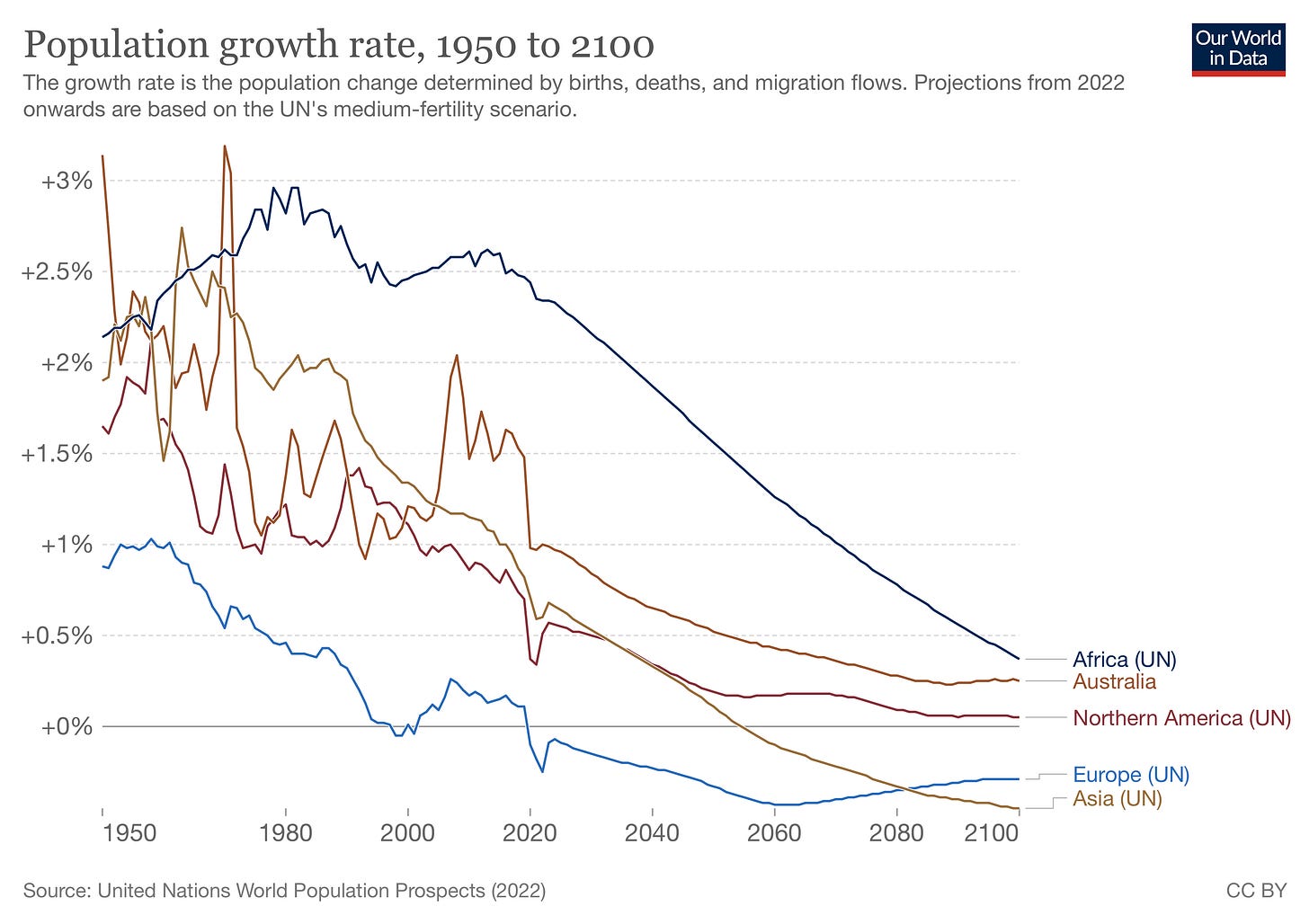

Population growth creates new demand and new supply. Population decline destroys both. In the United States and throughout the world, we’re skirting with population decline.

Productivity is the next big driver of economic activity. A great example of this is how ChatGPT and generative AI are already (and will continue to) shaping the world.

These AI programs can help one person (even a computer coder) now create ten times (or higher) the amount of work in the same amount of time.

One person’s exponential jump in productivity creates a higher output of goods and services. Which equals an increase in economic activity (GDP).

And now, we get to debt. A four-letter word and the third pillar of growth.

Our government is $31,000,000,000,000 in debt right at the second that I write this. Our debt to GDP ratio sits at over 120% (which mean the government would need to take all our economic activity for 1.2 years to pay off the current debt load).

But, debt is a key part of the economic activity equation. Without debt would you own a home? A car? Debt frees up cash to allow for investment.

But, it’s also the only lever that governments have direct control of.

A government cannot print more people or create more productivity. They can, however, print more debt.

Which brings me to the meat of this newsletter. We have far too much debt. Our birth rate is trending down. Productivity growth is also trending down (however that could radically change with new technologies).

So our economy relies on more and more debt to boost economic growth.

Think of productivity and population growth as two strong dogs pulling a sled (the economy).

When the population or productivity grows we add another dog to the team increasing our total pulling power (economic growth).

Now, think of debt as an option to give the sled a temporary boost. But, it comes with a cost. Every time we “boost” the sled we also add more weight to it.

Because we’re in an environment of slowing growth in productivity and population we’ve needed to “boost” the economy more using debt.

And now, instead of needing one boost to move the sled, we need two. In a year, we may need three.

Without adding more dogs, the sled needs more and more boost to push it.

This is where our economy sits. The debt that we’ve layered onto the economy for short-term boosts now weighs us down.

According to the National Bureau of Economic Research, as debt increases above certain levels of GDP, growth slows.

Productivity and population cannot pull us fast enough.

Which leaves us in a tricky position that only takes us in two directions:

1) Governments will issue more debt.

That’s a no questions asked certainty in my opinion. There’s too much demand for fiscal programs (healthcare, environment, defense, etc). Our government and the Fed will take the risk of devaluing our currency versus not spending money to satisfy their electorate.

2) Government will intervene in the economy more.

I wrote about this in a previous newsletter. Governments have four tools to influence economic activity. Think of these as their gas and the brakes for managing an economy.

Austerity - spending less

Debt Jubilee - forgiving and restructuring debts

Central bank policies - interest rates, money printer and stimmy checks

Taxes - no explanation needed

The first two options are political suicide. I assign an incredibly low possibility to each. Austerity and debt jubilees have real and immediate consequences. Governments will never do them and will always kick the can down the road.

While stimulus does carry the raw ingredients of catastrophic risk, from a political perspective those risks are far off in the distant future, abstract and elusive.

Taxes are popular among some of the electorate and highly popular among others.

Expect both central bank policies and taxes to be used as tools for managing the declines in productivity growth, an aging population, and our mountain of debt.

A final thought: the money printer will go BRRRRR just not how you think.

-Jared

One Sentence Summary: Population, productivity, and debt are the key levers that influence economic growth.

One Paragraph Summary: Debt, productivity, and population are the core drivers of economic activity. Because of a declining birth rate, flat productivity growth, and ballooning debt the main economies of the world will be forced to issue more debt and intervene in the economy more.

Dog sled analogy = excellent.

So is low birth rate a concern because there would be less consumers in the future? I wonder this because it seems we don’t have a lot of production in the US and companies complain about not having workers. Tax the wealthiest at a fair rate and incentivize statewide production. Unfortunately that’s corporate suicide. Appreciate your work as usual!