Like I talked about in my newsletter last week, our social-media society optimizes for the ideas and opinions that are not the most accurate or helpful but, instead, most viral. We succumb to the irresistible sound-bites and one-liners that fire up our emotional response.

Blame nature, not Mark Zuckerberg…

Your amygdala, part of the limbic system in your brain, creates your emotional responses. This part of the brain, colloquially called the lizard brain, drives our primal responses that keep us alive, the three F’s (feeding, fighting, and fucking).

We still carry strong evolutionary adaptations from the millions of years evolving in far different environments (wild nature). The most relevant survival driver to what opinions go viral are two emotions, fear and anger. These strong emotions arose to help us survive and form strong social bonds.

When we have an experience that triggers fear or anger in our bodies, our “rational” thinking mind (the prefrontal cortex) is not in control, the amygdala is. Our body interprets the information as danger which then triggers this ancient, survival-oriented part of our mind.

This is one of the great battles of our time. Technology and society have evolved exponentially faster than our biological hardware. When we see something online that triggers a strong emotional response it’s the exact same response we’d have if we were in the wild experiencing a life-threatening situation.

The amygdala and our limbic system do not know the difference between real danger or a well-written tweet. The thoughts and ideas that get repeated, quoted, and spread the most are the ones that target our deep emotional responses and hijack our biological hardware.

Now, this isn’t inherently a bad thing. Communicating in a way that reaches people’s emotions is a great strategy. It helps create messaging that people care about. We’re just seeing the dark side of it today, at scale.

One of the ideas that triggers a strong emotional response that’s getting widely spread today is canceling student loans.

Canceling student loans is a great example of the unvirtuous cycle I mentioned in last week’s newsletter that drives policy decisions and campaign promises.

It’s no different than this financial markets cartoon:

Someone makes a rational, nuanced statement, and it gets passed through the media until it’s shared with an enthusiastic fervor in its most simple, viral purity.

This fervor is noticed in polling and focus groups and gets introduced as campaign messaging by aspiring politicians.

Let’s get something straight. The student loan debt balloon is a huge failure of the federal government and has morphed into an unfettered money grab by colleges and universities (both private and public) across the country.

Does that mean the answer is to have President Biden wave his magic wand to make the debt disappear?

Of course not. But Biden needs to make good on his campaign promise, so here we are. The problem requires a more nuanced, thoughtful response. Yet, this is what we got… money printer going BRRRRRR…

Student loans cannot get discharged in bankruptcy, therefore, there is no forcing mechanism that sets a fair market value on the terms of loans or the cost of tuition.

In all other debt markets, the lender makes a calculation on the risk they are taking. This forces lenders to make rational decisions and set appropriate prices (through interest rates) on who they lend the money to and for what activities.

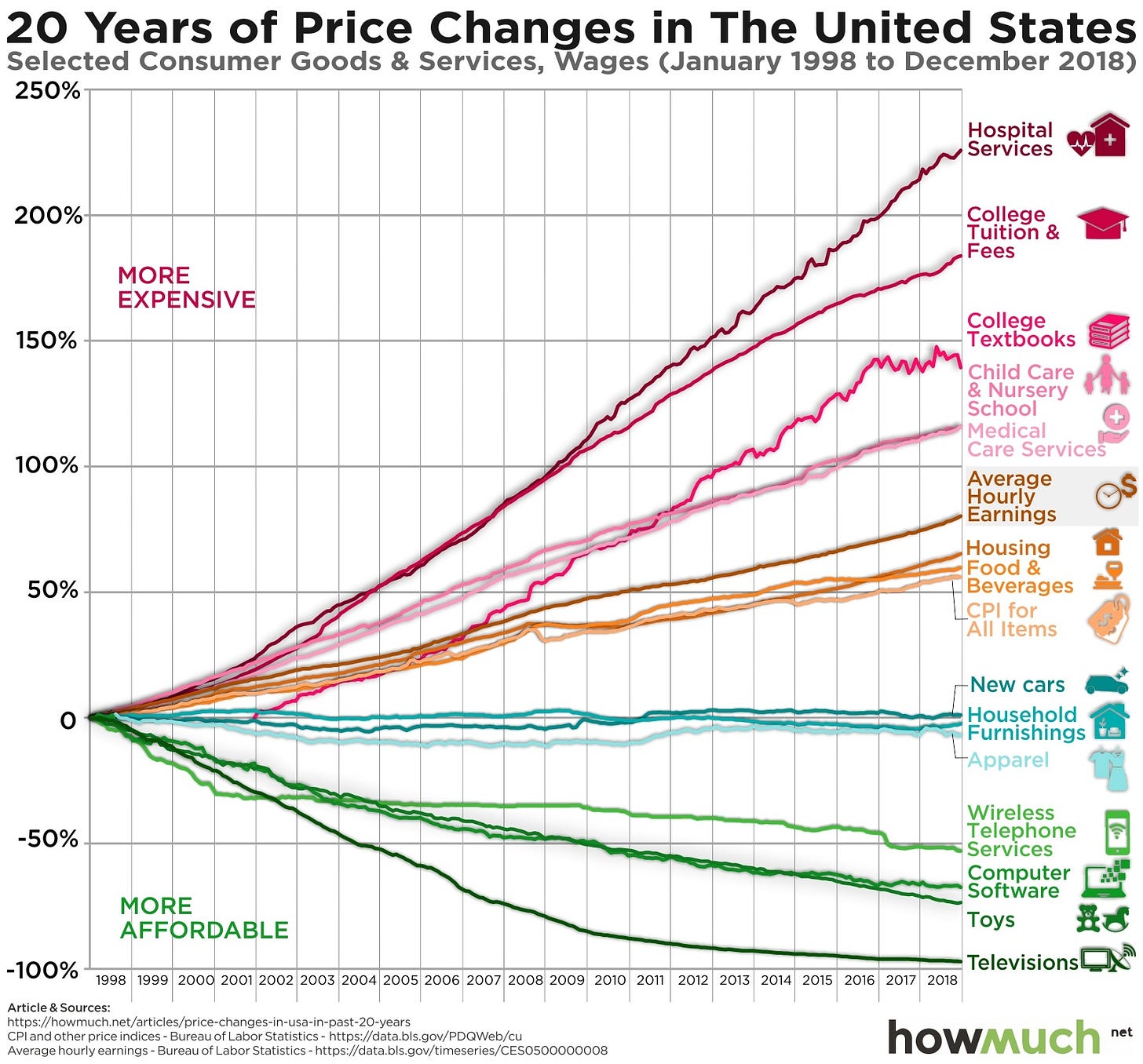

That’s not how it works for student loans. This creates a “sellers market” and runaway price inflation for higher education:

Trillions of dollars of free money, given to teenagers and young adults for the false-promise that they’ll go to college, get a job, and be financially set for the rest of their lives.

Instead, they received degrees indistinguishable from millions of other prospective workers, tens of thousands (many hundreds) of dollars of debt, and a justifiable feeling that they just got screwed by someone.

Because they did get screwed. And now we’re seeing the blowback of the last 30 years of free money given to students to give to universities.

Regardless of where you stand on the cancel all debt vs. make people pay debate, there’s a bigger issue that this standoff represents, the dole.

We have a political culture of raiding the bank account to gift trillions of dollars in “relief” or “stimulus” to constituents and using previous grifts as justification for this new one. Look at all that money that they got! We need our money too. That’s not fair!

This is a losing game that will bleed us dry through inflation and currency debasement. But, politicians don’t care. They’re incentivized to get short-term wins that they can fundraise around.

Stop the bleeding… focus on the root cause.

100% we have the ability and resources to offer public colleges that are tuition free and funded by state and federal taxes. BUT the student loan program is broken beyond measure. It’s a free money spigot for universities and colleges. The colleges are not responsible if there’s a measurable ROI on taking out the loan, and the government protects the money spigot by not allowing student loans to be dischargeable in bankruptcy.

Some reasonable and logical ideas on how to fix the student loan issue:

Make student loan payments tax-deductible, retroactively

Allow student loans to be discharged in bankruptcy

Exclude all for-profit universities from being eligible for student loans

Reserve federally guaranteed loans for specific career paths (doctors, nurses, teachers, STEM) and remove eligibility for all other programs

Each of these actions could help us restore some sanity into the lending market and force colleges to appropriately price tuition based on how much value they can deliver to their students.

If you’re looking for more information on this topic, I highly recommend the All-In Podcast Episode 93.

Here’s the relevant section on student loans:

-Jared