Financial group-think has become obsessed with bubbles.

There’s the housing bubble, the tech bubble, and the bubble of all bubbles, the Dutch “Tulip Mania” of the 17th century. And now, with central banks injecting more and more money supply into the economy many are calling the current epoch the “Bubble of Everything”.

And then, of course, we have the main argument against crypto, “it’s a bubble”.

But, out of all the bubbles I’ve named, only the Dutch tulip traders of the 17th century never recovered (there’s other examples but I’m keeping it simple).

Holding tech stocks through the bubble and subsequent crash has returned 1,000% and higher winners for the companies that survived. The US housing and real estate market has more than recovered from the pre-Great Recession highs.

So even though these assets were called bubbles, smart investors with proper allocation who held through the volatility returned massive profits.

So calling something a bubble doesn’t mean that the bubble pops and the assets never recover. If the “bubble” is hype and speculation but the underlying asset is still creating real-world use cases the chance of a pop and recovery is good.

And crypto, because it’s such a brand-new asset class, is getting slapped with the bubble term every day by detractors.

So, is crypto a bubble? And, does that even matter?

First off, crypto at its current stages is a massive, world-wide experiment in a new way of programming and exchanging value. That means at its core crypto is still in a speculative stage.

Which use-cases and business models reach mass adoption is not a done deal.

But, in my opinion, it is a done deal for crypto-based business models to create real world value.

This new, experimental stage is what creates the opportunity for generating alpha, but it also comes with a, let me use a technical term, shitload of volatility.

So what’s the experiment and how am I playing it?

The experiments are wide-ranging but a core theme among them is, “What happens when we remove the middlemen?”

Right now, our economy is filled with companies that are gatekeepers sitting between end users, facilitating the transactions, and accruing the value.

Banks control the lending, transferring, and “hosting” of your money. You pay them fees, they keep the profits and pay out minimal interest.

Amazon controls the hosting of your data (so does Microsoft, Google, and other tech companies). Again, you pay the fees and they keep the profits.

Facebook and other social media giants control the platform on which you’re a user. You pay none of the fees but give up personal data as your cost of entry.

Now, don’t get me wrong, I’m not against companies earning profits through providing a valuable service.

But, what if the service these companies provide can be replicated with computer code?

Instead of using a bank to get a loan, sending that bank reams of documents and proof of income, a crypto user can connect their wallet to AAVE (a crypto lending protocol built on Ethereum) and get an instant loan deposited right into their wallet.

No speaking to a banker, no waiting, and no red tape. All of the rules of the exchange are set by the computer code and the protocol.

Crypto creates a business model where computer code can replicate the operations of the bank, verifying assets/income and judging what is the protocol’s maximum amount of capital they’re willing to lend. All of this is done through a smart contract and executed in an instant.

Traditional banking is not going to disappear overnight... but massive competition is coming as crypto lending matures.

And, this same experiment, what if we replicate XYZ but using crypto, is happening all over the economy.

One of the next trillion dollar markets crypto is gunning for is art, community, culture, and gaming. Crypto-based business models connect creators directly to their audiences. Artists and creators have the ability to directly interact and monetize their audiences while at the same time allowing their audiences to benefit financially from participating.

One area that’s catching a lot of excitement right now is “play to earn” gaming. Using a combination of crypto technologies, companies are creating games where the users of the game benefit financially from playing and winning.

It’s creating an economy of attention. Users and creators both benefit.

With the majority of video games being the exact opposite business model where you “pay to play,” who’s going to choose that model when the crypto economy offers getting paid to play?

The macro point I’m making is that crypto, and its ability to disrupt existing business models while creating profit incentives for creators and users is one of the strongest positive feedback loops for adoption we might have ever seen for technology.

Once people get into this system, they’re not coming out.

Why would anyone stay on Facebook when a crypto-native version pops up that allows the users and the creators to both benefit financially from using and investing in the platform?

There are two main important points:

Crypto is disrupting many more areas of the economy than just money and savings. It’s building an entire new infrastructure for the internet where the users accrue the monetary benefits.

We’re still at the early beginnings. This is internet 1997 but growing even faster. There will be huge winners and far, far more losers.

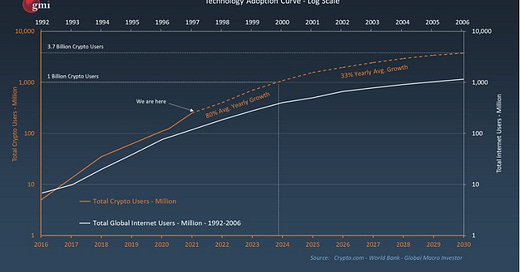

One way to look at where we are in the innovation cycle is how crypto adoption compares to the adoption of the internet.

This chart shows how crypto is averaging 80% annual growth in users and is growing faster than the internet did in 1997. The crypto economy is on track to have a billion users by 2024.

If you look at any other industry or economy in the world, nothing comes close to the growth the crypto economy is experiencing.

So, since I’m clearly sold on the bull case for crypto, I thought it’d be helpful to highlight my investing strategy.

The simplest part of the strategy is to acquire a “core position” in both Bitcoin and Ethereum. These are the two leading cryptocurrencies and no portfolio is complete without a majority exposure to these.

From my perspective, the core position is a position I do not intend on selling for five or more years (of course this can and will change depending on what happens in the economy and my personal life…).

My current strategy is to let my winners ride as these investments could have even higher return potentials than investing in Microsoft, Amazon, and Google in the 90s. But, that only works when I’m willing to hold through the ups and downs of this new, experimental market.

That’s why position sizing is important. I am positioned so that if everything blows up and goes to zero I’m still ok. That helps me sleep well at night.

Now, I don’t think this is going to happen but crypto can drop 50% in a month and the worst thing to do is panic sell on the lows. Keeping your position size appropriate for your risk tolerance is key to being able to add on dips.

My fundamental belief is that a major part of the future economy will be built on crypto. Whether it’s built on Bitcoin, Ethereum, or another project isn’t of concern to me right now because I hold both.

What’s of concern is that I’m allocated to the fastest horse in town that’s going to be running for decades to come.